Here's What You Need to Know About Elon Musk's Pay Package

Tesla shareholders are about to decide whether to give the founder and CEO an astronomical paycheck.

You might not have heard, but earlier in the year, a Delaware judge stopped Tesla from giving Elon Musk $56 billion.

It happened in January, shortly after the Wall Street Journal reported that insiders were concerned about Musk’s regular cocaine use, but before Reuters said that the Justice Department was investigating Tesla for securities and wire fraud.

This Thursday, June 13, Tesla shareholders will decide whether to reinstate the original pay package. It’s a case that captures some of the most extreme aspects of American society—runaway executive pay, the role of superstar CEOs, and corporate governance.

Here’s everything you need to know about one of the year’s weirdest and most convoluted stories.

How did Elon Musk end up with a $56 billion pay package?

It’s hard to imagine now, but back in 2018, Musk didn’t have a reputation as a conservative troll. He was largely considered a visionary thinker and CEO; that year, he was elected as a Fellow at one of the world’s oldest and most prestigious scientific institutions, joining luminaries like Isaac Newton, Ben Franklin, and Albert Einstein. And the academic world wasn’t alone. The popular press adored him, with Time magazine naming him on their “100 Most Influential People” list for the second time.

But Tesla was struggling. The company lost about a billion dollars that year, which in some ways was a big improvement after losing nearly $2 billion in 2017. The big driver of these losses was that at the time, Tesla couldn’t reliably produce vehicles. The company had more or less unlimited demand but sold about 245,000 cars. That seems like a lot until you realize it’s just 15,000 more than Ford sold in June that year.

So, Musk and the Tesla board came to an agreement, where he would get an insane amount of stock options if he exceeded a bunch of really ambitious growth targets. If the company takes off and meets the conditions, the thinking went, Musk would make billions, while shareholders would make trillions.

Is that normal?

Define normal.

It’s certainly normal for public companies to tie executive compensation to performance. It’s also common to give executives stock options if they achieve certain goals. Research has shown it is one of the primary drivers of the ever-expanding worker and executive pay gap.

What’s unique is the size and process that led to Musk’s agreement. In 2023, the highest executive stock award went to Hock Tan, the CEO of semiconductor designer Broadcom. The company granted him $160.5 million in stock, a ludicrous amount of money but a fraction of what Musk was slated to earn.

What made Musk’s agreement so lucrative?

The agreement had some revenue and profit incentives, but the whole thing was overwhelmingly weighted toward increasing Tesla’s market capitalization. That’s essentially what investors believe a company is worth and directly tied to a stock price.

Let’s say a stock is trading for $10, and has ten shares. Investors believe the company’s total value of $100.

Tesla’s market capitalization was around $59 billion when the deal was signed.

Musk's agreement paid him no annual salary but gave him ten years to earn 12 different stock grants–all activated if he increased the company's value past certain levels.

Musk surpassed all 12 of the milestones in three years.

Wait, the $54 billion is all because Musk increased Tesla’s stock price?

Yea. That was more or less the deal’s whole point.

To be clear, it was also very ambitious. Very few people thought Tesla would turn into a trillion-dollar company at its peak.

How did Tesla’s stock price/market capitalization rise so high so quickly?

That’s a great question, and unfortunately, there’s no real definitive answer. A stock’s price is determined by a number of factors: a company’s assets, revenue, and profits obviously influence its stock price, as do earnings forecasts.

But none of these things really explain Tesla’s rapid rise. Legacy automotive companies like Ford, General Motors, Stellantis, Toyota, and Volkswagen dwarf Tesla in nearly every conceivable traditional financial metric, but right now, Tesla’s market capitalization or market value is higher than all five combined.

That’s because stock prices take intangibles into account, such as vibes.

Vibes? What are you talking about?

One of the dirty little secrets about finance is that valuing a company is fairly subjective. It’s really about combining concrete numbers with a compelling narrative. Aswath Damodaran, a Professor of Finance at NYU, includes storytelling as part of his curriculum, and Musk is arguably the best to have ever done it. He’s done a remarkable job of communicating a vision to investors and the public that Tesla isn’t just an automaker but a genuine technology innovator.

It’s not all unwarranted. Tesla really does have a decade head start in electric vehicle technology, which hasn’t resulted in runaway earnings yet, but some analysts think it will. Investors seem to believe its embrace of software integration better positions the company for the future. Not to mention, Elon is constantly promising impending technology like self-driving cars and artificial intelligence.

In January, Musk told investors they needed to quit evaluating Tesla as an automotive company. “We should be considered an AI or robotics company,” he said.

And three months later, after the company reported a 55 percent decline in profits, he announced Tesla would enter the rideshare market with self-driving cars.

“We’ll be showcasing our purpose-built robotaxi, or Cybercab, in August,” Musk said. “We’re really headed for an electric vehicle, an autonomous future.”

It should also be noted that a good chunk of Tesla’s perceived future value is wrapped up in the belief that Musk and Tesla will actually be able to deliver on these ambitious promises.

Wait, hasn’t Musk faced accusations that he’s made false statements to boost Tesla’s stock price?

Yes.

In 2018, Musk tweeted, “Am considering taking Tesla private at $420. Financing secured.” In the aftermath, the company’s stock increased by more than 6 percent. The SEC charged him with securities fraud because there was actually no deal even considered or on the horizon. Elon and Tesla settled the charges, paying a $20 million fine and agreeing to pre-approve Musk’s tweets. Musk sued to overturn the pre-approval part of the settlement, ultimately losing his case at the Supreme Court.

Musk has long said that fully autonomous self-driving Teslas were just around the corner. In fact, he’s promised it each year, for the past ten years. In 2022, consumers brought a suit against the company, accusing it of false advertising around self-driving cars. That same year, he told investors that “Full Self-Driving will become the most important source of profitability for Tesla.”

In April, the National Highway Traffic Safety Administration closed an investigation into hundreds of accidents involving the software, 13 of them fatal. The agency, which is in charge of reducing deaths and injuries due to motor vehicle crashes, found that there was a “critical safety gap between drivers’ expectations of [Autopilot’s] operating capabilities and the system’s true capabilities.

Right now, the Justice Department is investigating whether Tesla misled consumers and investors on the capabilities of its autonomous driving software.

Who set Musk’s incentives?

Executive compensation at public companies is set by the board of directors. Think of the board of directors as executive advisors and company referees. The board most notably chooses the executives, but they’re also responsible for helping set the firm’s direction, while also making sure that the company’s actions follow both the law and the company’s internal policies.

Generally speaking, boards at major companies are supposed to be independent. Instead of doing a CEO’s bidding, they’re supposed to represent the interests of shareholders. The New York Stock Exchange and NASDAQ, America’s two major stock exchanges, require the majority of board members to be independent in order to be listed. They also have what’s called a fiduciary duty, meaning they need to make decisions in the company's best financial interest.

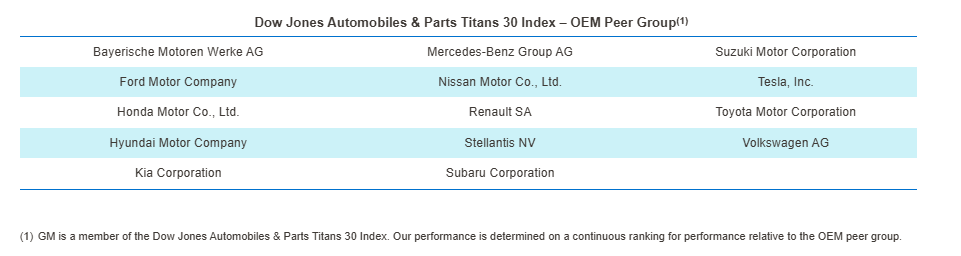

The board proposes how much executives should be paid through a compensation committee. Legally, compensation committees can more or less offer whatever they want. There are very few rules on what is and isn’t appropriate pay, but typically, boards use benchmarks. That means they’ll look at competitors, and see what type of salary, incentives, and stock options they’re giving executives.

For example, the image below is from General Motors’ annual shareholder communications. They evaluated 14 different competitors to determine their compensation plans.

The board will then create a pay package that shareholders vote on.

For Musk, in 2018, investors owning 73 percent of shares approved the pay package.

If there aren’t many laws on executive compensation, how was Musk’s pay overturned?

It connects back to that whole independent board member idea.

Tesla had nine board members throughout Musk’s pay package negotiation. One took a leave of absence after he was accused of illegal drug use and predatory behavior towards women, leaving eight. That means that 25 percent of the remaining board shared genes; one was Musk, the other was Kimbal, his brother. Tesla told shareholders in official documents that every member not named “Musk” was independent.

But according to the Delaware Court of Chancery, which is where Tesla is incorporated and thus why the case was tried in Joe Biden’s home state, this wasn’t true. Judge Kathaleen McCormick, the ruling judge, found that the compensation committee was led by board member Ira Ehrenpreis, a venture capitalist. Judge McCormick found that Ehrenpreis was a close friend of Musk who had over $75 million invested across his companies.

In fact, she ruled that all relevant board members were essentially dependent on Musk. Some regularly took family vacations with Elon; in one extreme case, Antonio Garcias, who was presented to shareholders as a “lead” independent director, had been friends with Musk for 20 years and had nearly $1 billion invested in his various companies.

These conflicts of interest were never disclosed to shareholders. Shareholders weren’t fully informed, which is the basis for Judge McCormick’s ruling overturning Elon’s pay package. “The description of the Compensation Committee members as ‘independent’ was decidedly untrue as to Gracias and proved untrue as to the remaining committee members,” she wrote in her ruling.

In fact, the Compensation Committee didn’t even benchmark Musk’s proposed compensation, with McCormick ultimately concluding, “They knew benchmarking would expose the Grant as multiple larger than any conceivable comparison.”

Crazy. Did shareholders feel duped? Is this whole thing a massive revolt?

Not really.

In fact, the suit was brought by one guy, a drummer in a thrash metal band. He is rumored to have owned just nine shares of stock when he sued the company.

To put that in perspective, Calpers, the California state public pension fund, owns over 9.5 million shares. But you’re allowed to do stuff like this if you own just a single share of stock. So if you’re not a fan of Musk, you might as well celebrate the little guy and shareholder activism.

So what are shareholders voting on next week?

They’re primarily voting on whether to reinstate Elon Musk’s 2018 pay package. The judge concluded that shareholders weren’t fully informed when they previously voted, so now they’re voting on it again. Tesla included the ruling to shareholders, so now everyone is informed.

Are shareholders going to vote for the pay package?

It’s hard to tell, but there are some troubling signs for Musk.

Institutional investors like pension funds and other asset managers own about 70 percent of Tesla shares. Glass Lewis and Institutional Shareholders Services (ISS), firms that advise institutional investors on these types of votes, told clients to vote against the proposal. The aforementioned Calpers said they’ll vote no. Asset manager Vanguard, Tesla’s largest shareholder, has so far stayed silent, but voted against the pay package in 2018.

Why wouldn’t shareholders vote for it?

The case against voting for Musk’s payday is pretty simple.

It’s an astronomical amount of money for one person, more than twice the amount of cash the company generated since it was founded. Musk doesn’t even give Tesla his full attention as he’s CEO of six other companies, including X. The absurdity of the situation is amplified when you consider that Musk’s actions at X may be actively damaging Tesla’s brand.

And actually, executing the agreement would lose shareholders money, as the additional shares would decrease their relative share of the company.

What’s the case for shareholders to vote for it?

The case for Musk is also equally simple: We agreed to this deal, let’s honor it. That’s the position of billionaire Ron Baron.

What’s Elon’s case for this huge payday?

That people need to pay him $54 billion so he can colonize Mars.

That’s not a joke.

Musk and numerous board members testified that his primary motivation for the massive payday is to save humanity from the existential threat of AI through space exploration. Space exploration is, after all, expensive.

The Delaware ruling concluded that “Musk genuinely holds those beliefs.”

How is Elon taking all of this?

Not well. In the past, he compared ISS to the terrorist organization ISIL and said Calpers has “no honor.”

In January, Musk threatened to scale back Tesla’s ambitious AI programs if he didn’t control a quarter of all votes in the company. The stock package would more than double his vote share and put him in striking distance.

He’s also asking for shareholders to move the company from Delaware to Texas–presumably because the courts ruled against his pay package.

Tesla’s board chair said Musk may leave Tesla if shareholders don’t reinstate his pay.

And he’s also offered investors one of the worst trades in the history of human civilization: vote for his pay package and you’ll get a tour of the Tesla factory.

On Thursday, we’ll see how convinced Tesla investors really are.